How many times have you read a news story about a mining project that was not measuring up to the financial projections of the initial mining study? These stories are not infrequent, so you would think that we would be learning from our mistakes by now. What is going wrong here?

The Problem with Single Value Inputs

While we must consider many inputs in a mining study, the critical inputs are:

- The geological model of what we believe is in the ground

- Financials related to costs and metal prices

- Metallurgical recovery

In a traditional approach, we take single expected values for each of these inputs to create a mine plan. This is where the problem lies.

- For financials, how do we know what the gold price will be in three years time?

- For recoveries, how do we really know how the plant is going to perform?

- For our geological model, how do we really know what the grades will be?

When we use single value inputs we don’t consider that price, grade or recovery are just estimates.

As for the geological model, grade estimates are just that – estimates. Remember the process you go through for one of those contests where you have to guess the number of jelly beans in a jar? You might try to do some mental maths by counting the number of jelly beans around the circumference of the jar, use that to estimate the number in a horizontal slice and then estimate the number of slices to get a total.

Well, grade estimation is a little more sophisticated than that, but at the end of the day, the grades are estimates based on the surrounding drillhole samples. What we actually get from that block when it is mined will most likely be something very different from the estimate.

To be fair, we often run a number of financial scenarios on metal prices to get base case, best case and break-even plans. That is a good start, but we can go much further than that if we increase the number of financial scenarios and bring in the other inputs of grade, recovery and costs.

Distributions vs. Single Values

The reality is that we don’t know exactly what metal prices, costs, recoveries and even grade are. So how can we plan with such uncertainty?

One answer is to follow what our peers in the oil and gas industry have been doing for decades. That is, working with probability distributions of the inputs to a plan.

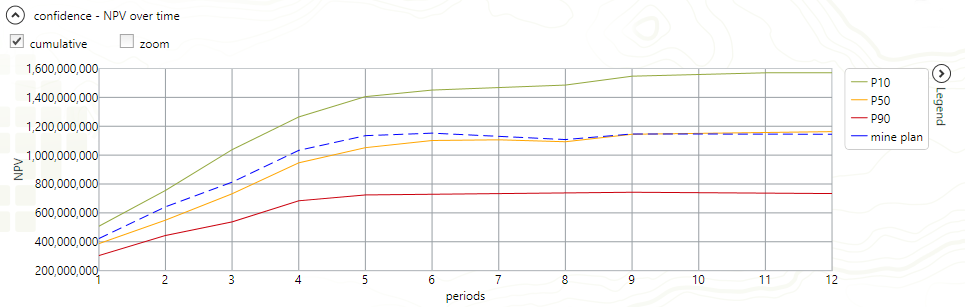

When we do this, just like our inputs, our KPIs of NPV, metal, ore tonnes and other parameters become distributions instead of single values as shown in the graph below.

These KPI distributions give us insight into the magnitude of the potential pitfalls or upsides to a project. For example, in the graph above, the p90 and p10 lines give guidance on how low and how high the NPV KPI may go. The p90 of $740M means that 90% of the cases exceeded a $740M NPV. Similarly, the p10 means 10% of the cases exceeded an NPV of $1.57B.

When we use distributions instead of single values, we admit “I don’t know for sure what the price, grade or recovery will be.”

In particular, we can either

- Understand how robust a mine plan is with respect to the many, many possible variations to the key input parameters, or

- Generate many different mine plans, one for each combination of inputs, and analyze the KPI distributions

But where do these distributions of financials and grade come from?

The Monte Carlo Method and Conditional Simulation

There are accepted practices and methodologies to determine financial and grade uncertainties.

The Monte Carlo Method is used to analyze risk related to financials and recoveries. It samples from probability distribution functions for costs, prices and recoveries.

For the orebody, there is a technique called Conditional Simulation that has been around for quite some time now. For a given orebody, we can generate hundreds of sample block models. All samples have the same probability of occurring.

With sample values for financials, recoveries and the orebody grades, we can calculate KPI distributions for a mine plan. KPI distributions give much more insight into a project than single value KPIs.

Putting it into Practice

Carrying out this analysis can be quite tedious and time-consuming with planning software that is not designed for risk analysis. You would typically follow this procedure:

- Create a mine plan based on average values

- Generate sets of sample values for financials and recoveries external to the software using Monte Carlo

- Generate a set of equally probable conditionally simulated orebody models

- From steps 2 and 3 generate scenarios of financials, recoveries and grade to apply to the mine plan

- For each scenario applied to the mine plan, calculate the KPIs

- Collect all of the KPIs and develop 10, 50 and 90 percentile graphs over time

This process can be quite prolonged with conventional software that has not been designed for risk analysis that considers both grade and financial uncertainties. I have spoken with companies that have planned this way with grade and financial risk. They have said that the manual work of getting all of the KPIs out of the software and into excel for charting was very taxing to manage.

Mine planning software expressly designed for grade and financial risk can dramatically reduce the time spent conducting your risk analysis.

Another option is to use software formulated for risk analysis such as Minemax Planner. It works with conditionally simulated models, and does all of the Monte Carlo sampling, KPI calculation and risk analysis graphing within the software.

In fact the image above comes directly out of Minemax Planner version 4.1.0, due to be released shortly.

Interested? Connect with Minemax on social media or subscribe for General Minemax News and be one of the first to test a free demo of Minemax Planner with the Risk Analysis options when it is released.

Know anyone else whose plans may need to manage uncertainty more accurately? Give them a hand and share this article using the social medial icons below.